News

NdFeB Magnets

Tracy Moon and Shuk Rashid, Tridus Magnetics and Assemblies and Zhong Ke San Huan High Tech

New methods leading to the reduction of heavy rare-earth elements in NdFeB permanent magnets with enhanced coercive force are being implemented by magnet manufacturers

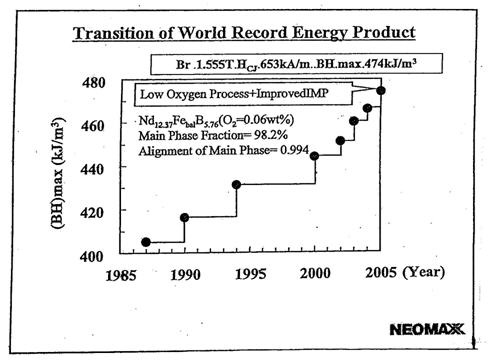

The advent of rare earth-transition metal alloys, or inter-metallic compounds, such as samarium cobalt and a ternary system composed of neodymium iron and boron (NdFeB) permanent magnets revolutionized the usage of permanent magnets. The latter alloys (Figure 1) with their extremely high coercive forces and substantially higher energy products (as compared with their predecessor systems, alnico and ceramic) not only simplified the design of magnetic circuits, but made possible the miniaturization of a vast array of magnetic devices. Nevertheless, the lower Curie temperature of this alloy has made it prone to loss of coercive force (Hci) at higher operating temperatures.

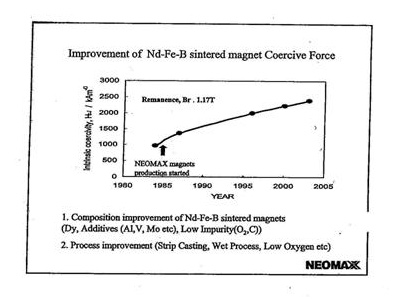

There has been a constant improvement in coercivity of NdFeB magnets since their inception. Figure 2 shows the latter improvement. Increase in demand for NdFeB magnets coupled with a relative shortage of heavy rare earths (HRE) such as dysprosium (Dy) and terbium (Tb) has persuaded magnet manufacturers to price the alloy, among other factors, as a function of the content of HRE, causing fear, uncertainty and skepticism among magnetic device designers and manufacturers. This was the genesis of the decision by magnet manufacturers to launch an orchestrated attempt to reduce the content of HREs or partially replace the latter rare earths, with more abundant and less used HREs such as holmium and others.

Using heavy rare earths

Light rare earths couple ferromagnetically with transition metals, resulting in higher saturation magnetization. NdFeB, with its high saturation magnetization and extremely high-energy product, does have a drawback. That is, the coercive force of this alloy system suffers exponentially as the operating temperature of the magnet increases.

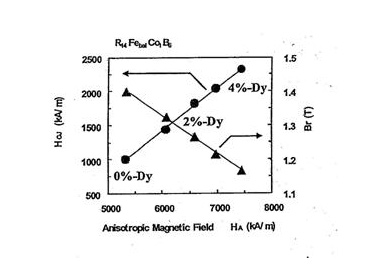

To remedy this situation selectively, a portion of Nd (light rare earth or LRE) is replaced by HRE (Figure3). Although HREs coupling with transition metals ferromagnetically produces a somewhat lower saturation magnetization, it does increase the anisotropy field of the alloy and therefore increases the intrinsic coercive force (Hci) of the magnet. The degree of enhancement of Hci is a function of the content of HRE. The higher the content of HRE, the higher the coercive force will be. However, there is an upper limit beyond which the coercive force starts to show a gradual decline.

Improved melting technology

Strip casting technology was a much more powerful tool affecting the efficiency and quality of NdFeB magnets than any other changes since the inception of manufacturing of sintered Nd magnets. It is prudent to observe that the transition from the classical book mold and cup cake (ingot melting) process to strip casting has improved the efficiency of usage of HREs (which are associated with higher vapor pressure and excessive loss of HREs in the melting process) to a great extent. Strip casting is another term for rapid quenching process or centrifugal casting. This process produces thin strips of alloy (as opposed to that produced by ingot casting) by dropping the molten alloy on a single or twin rollers rotating at high speed, causing the molten alloy to solidify to a thickness of 0.03mm to perhaps as thick as 4-5mm. The strips used for production have been in a narrow range of thicker than 0.1mm and thinner than 0.3mm. Strips of solidified alloy exhibit a columnar crystal that grows from the surface of the roller in the direction of thickness of the strip. The remarkable improvement in the microstructure of the rapidly solidified NdFeB strips (columnar structure of hard magnetic grain) greatly enhances the homogeneity and the unit properties of the magnet produced from the strip cast material.Strip cast of NdFeB type composition, containing niobium (Nb) or molybdenum (Mo) in the range of one atomic weight percent, has considerably improved the coercive force of this alloy without a substantial loss in the in (Br).

Without the advent of rapidly solidified strip casting of NdFe magnets, the current degree of improvement in the use of HREs would have been virtually impossible. Figures 4 and 5 show the effect of Nb on Hci and Br. Figure 6 shows the grinding resistance for the sintered NdFeB magnet as a function of the content of Nb – the higher level of Nb significantly increases the resistance to grinding. Therefore, there is a limit as to how much Nb can be added to the alloy.

Dysprosium grain boundary diffusion

One successful method of enhancing the coercive force of NdFeB magnets is to diffuse dysprosium into the grain boundary of an alloy made of Nd, Fe, B (no heavy rare-earth elements) either in the form of strip-cast or finished magnets.

The crystal anisotropy of the magnetic grains surface region is always lower than that of the inside of the grains, as this region suffers defects and is under stress.

The principle of grain boundary diffusion is based on the premise that when a reverse magnetic field is applied to a magnet, magnetization reversal happens to all particles making up the mass of the magnet. The latter reversal starts from those particles that nestle on the surface of the particles. If the concentration of

The concept of grain boundary diffusion started with finished uncoated magnets. In light of the fact that the process consists of a secondary operation, at temperatures exceeding 700ºC, the process was not deemed appropriate for magnets with less favorable aspect ratios (the ratio of the magnet thickness to the magnet surface area). Thinner magnets with a large surface area and small thickness-unfavorable aspect ratio did suffer enough deformation and warping to be classified as rejects. So the process would lend itself only to a select group of geometries. This process may be ideal for applications where the magnet is small and not prone to deformation on account of high temperature exposure.

The alternative method of grain diffusion with which the magnet manufacturing industry has been successful is the Dy grain boundary diffusion of cast strips, and the ultimate manufacturing of the magnets by using the conventional powder metal process.

Nanocomposite NdFeB magnets

Quantum size effects have spawned much interest among magnet scientists and technologists. As the size of particles in a nanocomposite structure decreases, there is an increase in the fraction of surface energy (surface atoms), which could lead to a considerably higher energy product in the permanent magnet. The magnetic properties of magnets made from nanoparticles, among other factors, is a function of the chemical composition, the microstructure, the size and the shape of the particle, the crystal lattice and the morphology of particles. Controlling the latter parameters within a given range in the process of synthesis of nanomaterial will be, if not impossible, very difficult. Therefore, the properties of nanomaterial of the same type will be significantly different. The majority of the current high-energy magnetic alloys are of complex composition. As a result, this causes the range of parameters in the synthesis of nanomaterial to be extremely narrow.

The various processes of synthesis of magnetic nanomaterial also go completely against the principle of maintaining the proper stoichiometric ratio that is necessary in order to achieve sound magnetic properties.

For example, if the stoichiometric ratio of Nd2Fe14B or SmCo5 alloys changes during the synthesis, the resultant phases may be either slightly magnetic or non-magnetic; thus it significantly reduces the unit magnetic properties of the stated alloys.

The synthesis of such nanocomposites may require a manufacturing method that is entirely different from the existing powder metal method of manufacturing. The cost of the magnet is a function of the new manufacturing technology. If the latter cost is too high, the product may not be deemed viable. The manufacturing of nanocomposite of NdFeB was orginally proposed by a Japanese firm as early as the late 1990s. The firm, in cooperation with a major university in the USA and one in

Japan, actually managed to produced a very high- saturation and low-Hci magnet using a unique method of synthesis.

Temperature control methods Magnetic circuit designers and final device engineers have used their imaginations to design mechanisms that control the working temperature of the device, making the magnet less prone to high-temperature exposure. This supplementary device may take the form of a cooling device external to the magnet or any other temperature- control mechanism that will essentially perform the latter task.

There are many existing and new methods being developed where magnet manufacturers are reducing the use of HRE elements. There is also an intensive effort being launched to eliminate the use of the latter family of elements altogether.

References

- Yukata Matsuura: Current Status of NdFeB Magnets In Japan- China Magnetics Shanghai, September 2006, China Magnetics Conference

- Karl J Strnat, Herb Mildrum,T.K.Tan –Sintered NdFeB magnets Modified with Holmium and Cobalt- “The Tenth International Workshop pm Rare Earth Magnets May 1989

- Private dialogs with Matsuura in reference to Grain Boundary Diffusion of Dysprosium

- Naoko Ono, Massato Sagawa, R.Kasada” Production of High Performance Magnets by Grain Boundary Diffusion, Journal of Magnetics and Magnetism, February 2011

- Hongwang Zhang,Shen Peng, Shuan-bing Rong,J.Ping Liu, Ying Zhang,M.J.Kramer,Journal ,of Material Chemistry June 6th 2011

- Magnetic Nanocomposite Materials for High Temperature Applications- Frank Johnson, Amy Hsio,ColinAshe, David Laughlin, David Lambeth, Michael McHenry- Carnegie Mellon University and Lajors K. Varga ,Hungarian Academy of Sciences, Budapest, Hungary

- S P Gubin, Yu A Koksharov,G.B.Khomutov,G Yu Yurkov, Russian Chemical Reviews 2005

- Shuk Rashidi, Use and Reduction and Probable Remedies of Heavy Rare Earths in Proceedings of the International Workshop on Technology and Economics of Rare Earths and Metals – 2011

- Shuk Rashidi, Global Magnet Market: NdFeB Price Escalation and Revised Manufacturing Paradigm- China Magnetics Conference 2007 Beijing China

- Optimization of the Geometry of Strip Cast NdFeB Alloy – Beijing Zhone Ke San Huan High Tech Ltd- private communication

Cerium in High-Energy Magnets

Shuk Rashidi and Tracy Moon, Tridus Magnetics and Assemblies, in cooperation with Beijing Zhong Ke San Huan High Tech

Cerium in high-energy magnets

The need to develop cerium-containing alloy is growing in importance, not least because of the substantial benefits the technology offers in terms of production, cost and engineering

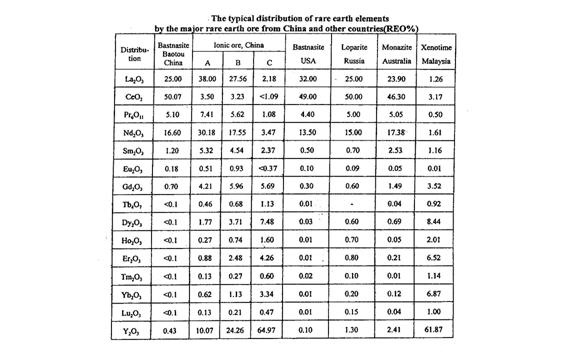

Typically, bastnasite rare earth ores in nature contain 49% cerium (CE), while in monozite deposits, one can expect to find approximately 46% Ce, as detailed in Table 1. Praseodymium (Pr) and Neodymium (Nd) are generally found in twin form in nature, and the combination of these two elements is referred to as didymium (‘di’ means two in Greek, and the names of both elements end with ‘dymium’). Modern high-energy permanent magnets tend to be of a didymium iron boron makeup rather than pure neodymium iron boron.

It is clear that cerium accounts for up to 49% of naturally occurring rare earths, but final high- energy permanent magnets do not contain any cerium at all. So how can cerium be used and what are unit magnetic properties of cerium- containing alloys?

Cerium is more plentiful in terms of availability and is cheaper than neodymium and praseodymium. It is also much cheaper than dysprosium and terbium. The study of cerium- containing alloy is not, however, new. Wallace, Craig and Schaller of the University of Pittsburg looked at the anisotropy of Ce2Co17-xFex as early as July 1972, and discovered that Ce2Fe17 alloy did have c-axis anisotropy while Ce2Co17 had basal- plane type anisotropy. Yet despite this, the anisotropy of the alloy was not conducive to making a high enough coercive force.

The use of cerium in high-energy permanent magnets began in early 1970s when Karl Joseph Strnat (generally considered the father of modern rare earth-transition metal permanent magnets), indicated in his 1976 paper for Dayton University, that Vogel and his colleagues had published the first phase diagram for CeCo5 in 1947.

Buschow and his team studied the change in anisotropy of SmCo5-CeCo5 as a function of 22 TECHNOLOGY INTERNATIONAL 2014 Most Magnet Manufacturers today purchase their alloys froM organizations that are equipped siMply to Melt various grades of alloys. their charter is not to supply actual Magnets. to expand their business they Must not lose sight of the need for rare earth Magnets with less robust unit Magnetic properties, at a reasonable cost, using rare earth eleMents that are More abundant temperature in mid-1975. By that time, Martin Wells and Dev Ratnam of the Crucible Research Center had produced and documented the manufacturing process for making misch-metal cobalt (MMCo5) magnets. Misch-metal is a naturally occurring ore that contains effectively all the rare elements in combined form. The MMCo5 magnets were made using a natural stream of bastnasite-type rare earths with a host of other light and heavy rare earths including lanthanum (La), mixed to the proper stoichiometric ratio of one to five between rare earth and cobalt. Later Ratnam and Wells varied the content of cerium to achieve a magnet with marketable unit magnetic properties. Nevertheless, the Crucible Research Center soon abandoned the practice of making cerium-containing alloys, for the simple reason that because the cost of the raw material was only a tiny fraction of the total manufacturing cost (small magnets and highly labor intensive), the final production cost would not be very different between samarium-based magnets and MMCo5 magnets. The lack of repeatability of the magnetic properties from one batch to another, as well as from one part to another part, was a secondary reason for stopping the program in its entirety.

DL Martin of the General Electric Research Center (Schenectady, NY) produced a cerium containing alloy of Sm1-xMMxCo5, with energy capacity of 14.5-18.0MGOe, where x ranged between 0 and 0.4. The magnets exhibited an intrinsic coercivity ranging up to 24kOe. The lack of repeatability of magnetic properties between material lots, as well as the small difference in terms of the selling price of MMCo5 and SmCo5 magnets, damped the enthusiasm of magnetic circuit designers around the world and therefore magnet manufacturers abandoned the practice for more than a decade.

KHJ Buschow of Philips Research Laboratories determined that the magnetic properties of several compounds of RCo5 (cerium and samarium) are strongly related to magnetocrystalline anisotropy. When Buschow studied the characteristics of the CeCo5 system, cerium was considered a rare earth element with potentially high anisotropy when combined with transition metals such as iron and cobalt.

Cerium in NdFeB alloys

In 1985 M Okada and M Homma of Tohoku University in Sendai, Japan, observed the process of making pure rare earth alloys by using a rare ore containing 49% Ce and a host of other light and heavy rare earth oxides. The separation of pure Nd and pure Pr was more complex, and therefore very expensive. Figure 1 shows the typical process of generating pure Nd and Pr. Rare earth ore typically has a host of light and heavy rare earths. The extraneous elements are removed as the first order of priority and then La has to be removed in its entirety. Leaving a small percentage of Ce would reduce the cost of the processing substantially, especially as bringing the content of Ce down to almost zero in the alloys will need many more expensive steps. Nevertheless, the remaining Ce content will reduce the intrinsic coercive force of the alloy and this reduction will be proportional to how much is left in the final alloy.

Making didymium the base alloy

To determine the effect of cerium on rare earth iron boron magnets, Okada and Homma selected three Ce-containing alloys with the following compositions:

NdFeB alloy with no cerium-Nd – 10%wt Pr

NdFeB alloy with 5% cerium-Nd – 15%wt Pr, 5% Ce (5Ce-didymium)

NdFeB alloy with 40% cerium-Nd – 10%wt Pr,

40% Ce (40Ce-didymium)

The range of the unit magnetic properties achieved with the above Ce-containing alloys ranged from from 27-40MGOe with various values of the intrinsic coercive force depending on the content of Ce-didymium. It is important to note that the alloys were made using an induction vacuum melt process, crushed into 258µm (average) particle size, and ball milled to a 3-4µm average particle size with the oxygen content being substantially higher than with the modern

Anistrophy in SmC05

methods of manufacturing. In other words, the vacuum-melted buttons may have had some inhomogeneity across their depth and thus the microstructure may have been less conducive to making high magnetic properties. Despite this, the result of the process was immensely encouraging and the future seemed to be very promising for ceruim containing alloys. A typical NdFeB alloy today is made of strip cast alloy that is subsequently hydrogen-decrepitated and jet milled with a much lower oxygen content and much improved particle distribution. As a result, enhanced unit magnetic properties have been realized.

One important observation that can be drawn is that the distribution of Ce and Nd in this alloy is impressively even, but the distribution becomes uneven as the content of Ce increases and the magnetic properties deteriorate.

Manufacturing of cerium A modern approach to producing Ce-didymium permanent magnets includes strip casting the alloy; hydrogen decrepitation of the alloy; jet milling to an average of 3µm particle size with a reasonable Gaussian distribution; hydrostatically NdFeB magnets

The saturation magnetization of 13.7kG for the Ce-didymium alloy is far lower than that of the didymium base alloy. Furthermore, the curie temperature of the modified alloy could be as much as 15-20°C lower than the didymium alloy.

The didymium alloy exhibits a curie point of around 310℃. However there are applications in use today – as well as potential future examples – where the intrinsic coercive force of the modified alloy will be more than sufficient. shows the relationship between a typical NdFeB magnet and a Ce-didymium magnet produced using the above manufacturing steps.

Most magnet manufacturers today purchase their alloys from organizations that are equipped simply to melt various grades of alloys. Their charter is not to supply actual magnets. To expand their business they must not lose sight of the fact that there is a need for rare earth magnets with less robust unit magnetic properties, at a reasonable cost, using rare earth elements that are more abundant.

They will need to develop Ce-containing alloy to essentially accomplish two goals: first, to maintain the cost of the rare earth alloys at a price level where it will not choke the current and future use of these magnets in applications where super high-magnetic characteristics may not be needed; second, to use the most abundant rare earth element and help ensure the proper usage balance between the heavy and light rare earths.

pressing at a magnetic field of 20kOe, and subsequently cold iso-statically pressing the part; and sintering at a temperature of around 1,020℃ and annealing at 520℃.

These key manufacturing steps apply to an alloy of generic form, such as (Nd1-xCex)30FebalanceB1.0 with X being 0, 0.1, 0.15 and 0.2. The best result was achieved for X=0.2, with unit magnet properties of Br = 13.7kG, Hci of 12.0kOe and BHmax of 41.0MGOe. The pure Ce-based alloy with the C2Fe14B structure will have a much lower Br and intrinsic coercive force and therefore a lower energy product. This is because the magnetic moment and the anisotropy of Ce2Fe14B are lower than Ce-enriched alloy, as well as being much lower than the pure NdFe14B alloy.

The important factor in achieving a high Br and a higher density magnet has been the use of a dual component alloy. Ce2Fe14 alloy has very low anisotropy of less than 40kOe, while Ce-enriched didymium alloy will achieve a high densification at a low temperature of around 1,020℃.

Schematic illustration of extraction process of the rare earth elements from ore

References

- Karl Joseph Strnat: Introduction to the Workshop, Rare Earth Cobalt Permanent Magnet And Their Applications, Dayton, June,1976

- Karl Joseph Strnat: Review of Rare Earth Magnets, Rare Earth Cobalt Permanent Magnets And Their Applications, June 1976

- Ratnam, DV, and Wells, MGH, AIP Conference Proc.N0.18 Part 2, p1154 (1974)

- HG Schaller, RS Craig and WE Wallace, J.Appl.Phys. Vol.143, No.7 July 1972

- H Domazer: New Substituted SmCo, Workshop Rare Earth Cobalt, June 1976

- M Okada, M Homma: The Properties and Microstructure of Ce-Didymium, International Workshop on Rare Earth Magnets, May 1985, Dayton

- Crucible Research Center/Crucible Magnetics; private notes and studies of MMCO5 trial runs and manufacturing procedure Panchnathanl Viswanathan: US Patent 6261387, Magnequench International Inc.

- DL Martin and MG Benz, Cobalt Rare Earth Permanent Magnet Alloys, International Conference on Magnetism, Grenoble, France, September 1970

- AM Diepen and KHJ Buschow, Philips Research Laboratories, Eindhoven, The Netherlands,The Origin of High Uniaxial Magnetocrystalline Anisotropy of SmCo5, 1975

- Haibo Feng, Anhua Li, Jingdai Wang, Shulin Huag, Minggang Zu and Wei Li, Fabrication of High performance NdCe-containing magnets, International Workshop on Rare Magnets and their Applications,September 2012, Nagasaki, Japan

Hitachi Metals seeks Cease and Desist Order

August, 20. 2012 10:00AM JST

HITACHI METALS FILES COMPLAINT IN THE ITC FOR THE INFRINGEMENT OF SINTERED RARE EARTH MAGNET PATENTS TOKYO, JAPAN, AUGUST 20, 2012-HITACHI METALS, LTD. (TOKYO : 5486) ANNOUNCED TODAY THAT ON AUGUST 17, 2012, IT FILED A FORMAL COMPLAINT WITH THE UNITED STATES INTERNATIONAL TRADE COMMISSION (ITC) AGAINST 29 MANUFACTURERS AND IMPORTERS OF SINTERED RARE EARTH MAGNETS AND PRODUCTS CONTAINING SINTERED RARE EARTH MAGNETS. HITACHI METALS SEEKS EXCLUSION ORDERS FROM THE ITC PROHIBITING THE ENTRY INTO THE UNITED STATES OF UNLICENSED, INFRINGING SINTERED RARE EARTH MAGNETS AND PRODUCTS CONTAINING THOSE MAGNETS AND CEASE AND DESIST ORDERS PROHIBITING CERTAIN ACTIVITY WITHIN THE UNITED STATES.

Hitachi Metals has chosen to exercise its intellectual property rights by filing a complaint with the ITC, and to seek exclusion orders and cease and desist orders for the infringement of U.S. Patent Nos. 6,461,565; 6,491,765; 6,527,874; and 6,537,385.

The proposed respondents named in the complaint include:

- Yantai Zhenghai Magnetic Material Co., Ltd.;

- Ningbo Jinji Strong Magnetic Material Co., Ltd.;

- Earth-Panda Advance Magnetic Material Co., Ltd.;

- Skullcandy, Inc.;

- Beats Electronics, LLC;

- Monster Cable Products, Inc.;

- Bose Corp.;

- Callaway Golf Co.;

- Taylor Made Golf Co.;

- Adidas America, Inc.;

- Milwaukee Electric Tool Corp.;

- Techtronic Industries Co. Ltd.;

- DeWALT Industrial Tool Corp.;

- Electro-Voice, Inc.;

- Shure Inc.;

- AKG Acoustics GmbH;

- Harman International Industries;

- Maxon Precision Motors, Inc.;

- Dr. Fritz Faulhaber GmbH & Co. KG;

- Micromo Electronics, Inc.;

- TELEX Communications, Inc.;

- Bosch Security Systems, Inc.;

- Electro-Optics Technology, Inc.;

- Nexteer Automotive Corp;

- Bunting Magnetics Co.;

- Viona Corp.;

- Allstar Magnetics LLC;

- Dura Magnetics Inc.; and

- Integrated Magnetics, Inc.

Hitachi Metals owns over 600 patents worldwide relating to sintered rare earth magnets, including over 100 patents in the United States alone. This significant patent portfolio contains patents essential for the safe, efficient, commercial manufacture of sintered rare earth magnets. Notwithstanding the broad scope of this patent portfolio, it has come to the attention of Hitachi Metals that a number of unlicensed magnet manufacturers have been importing, selling for importation, and/or selling after importation into the United States infringing sintered rare earth magnets and products containing those magnets.

PRESS INQUIRIES

Akio Minami

Corporate Communications

Hitachi Metals, Ltd.

E-mail: [email protected] Tel: +81-3-5765-4079 | Fax: +81-3-5765-8312

1-2-1,Shibaura Minato-ku,Tokyo 105-8614 Japan http://www.hitachi-metals.co.jp

Highfliers Find Lower Orbit

By LIAM PLEVEN (WSJ) October 7, 2011

Rare earths, an obscure group of commodities, are facing a fate similar to their more common brethren: Once-soaring prices are nose-diving, catching investors and producers off-guard.

Prices have declined as much as 20% to 50% since midsummer for some of the 17 rare-earth elements, according to analysts and market participants. Rare-earth elements are used in consumer electronics, automobiles, lighting and some military weapons.

Enlarge Image

The comedown is particularly sharp because rare earths had been among the highest-flying assets recently, seeing gains of as much as 30-fold over five years. Shares of Molycorp Inc., which is ramping up production at a California mine, have shed half their value since May, though they rose $4.19, or 13%, to $36.45, on Thursday.

Rare earths shot up as worries rose that China, home to about 90% of the world’s supply, could restrict exports.

Now, miners elsewhere are racing to increase production, investors who had hoarded the elements are dumping them and firms that use the materials face sliding demand.

“It’s too early to say that the downward pressure is over,” said Anthony Young, an analyst at Dahlman Rose, a natural resources-focused investment bank, who said some prices could fall a further 50% or more. “I don’t think that they’ll go back to their peak levels anytime soon.”

Unlike most commodities, rare earths aren’t traded on exchanges, and pricing often is based on a limited number of transactions.

“There’s no transparent market for this stuff,” said Jack Lifton, founding principal at consultant Technology Metals Research LLC.

Overall, rare-earth prices have fallen about 15% to 20% from their highs this year, Michael Silver, CEO of American Elements, which makes materials that include rare earths, said in an email. The drops haven’t been across the board, and europium and ytterbium prices remain high, he said.

Lanthanum and cerium, the most heavily produced rare earths, plunged from $150 to $80 a kilogram in recent months, Mr. Young said, a 47% decline. He said neodymium fell 22%, to $265 from $340 per kilogram. By comparison, neodymium cost $10 in 2006.

The declines could be good news for some companies and U.S. military strategists, which have been feeling a pinch from price increases and possible shortages.

Magnets made with neodymium power cellphones and wind turbines, cerium is used to polish flat-screen monitors, and europium puts the red in cockpit displays and televisions.

Toyota Motor Corp.’s Prius and other hybrid vehicles have lanthanum in their batteries. Smartphones and cellphones contain neodymium-based magnets that enable their vibrate function.

For manufacturers, the bite of more expensive rare earths has been substantial. Harman International Industries Inc., which makes audio equipment for cars, recently told investors that pricier neodymium, used in speakers, will increase the firm’s costs by $85 million a year.

Harman is seeking substitute materials and asking partners to share the pain. “That’s a work in progress,” said Jean Lepine, a Harman spokesman.

But neodymium’s recent decline in price “pales in comparison to the 500% increase in the last 18” months, Mr. Lepine said.

Price cuts and expanding supplies also could influence military planning. The Pentagon has been concerned about securing materials it considers strategically important. Rare earths are used in military gear, including missiles and night-vision goggles, according to Mr. Silver of American Elements.

The Defense Department soon will report to Congress how it plans to manage any potential supply-chain problems regarding rare earths if they arise.

Wednesday, October 12, 2011

Use, Reduction and Probable Remedies of Heavy Rare Earth Metals in Neodymium Iron Boron Alloys

by

Shuk Rashidi

Vice President

Tridus Magnetics and Assemblies

Rancho Dominguez, CA

Abstract—The advent of NdFeB permanent magnets ushered in a slate of new applications that were virtually impossible with the existing families of permanent magnet alloys.The lower Curie Temperatures and the associated thermal magnetization losses of Br and Hci, made the use of NdFeB magnets difficult if not down right impossible- in host of high temperature devices.To enhance the anisotropy field of this family of alloys, a portion of light rare earths was replaced by heavy rare earth metals. The latter enhancement was accompanied by some loss of remanence and the problems of a poor balance between the heavy and light rare earth metals. This paper addresses the benefits and the problems associated with the heavy rare earths and the potential attempts to reduce and or avoid the dependence on heavy rare earths wherever and whenever possible.

Keywords-

I. INTRODUCTION

Up until 1983, SmCo5 and Sm2Co17 made up the bulk of magnets used in miniature, high performance devices, ranging from computer disk drives to a host of factory automation, office automation and automotive components. The extremely high energy products and the superb Curie Temperatures of the latter alloys ushered in a host of new applications which were virtually impossible with other existing families of permanent magnets. The cobalt crisis of 1977, when the Katangese rebels invaded Zaire and flooded the cobalt mines and causing the price of cobalt to escalate to better than US$ 40.00/lb from a low of US$ 4.00/lb – in the gray market, instilled fear in the minds of many manufacturers, not to mention the magnet users. The magnet laboratories through out the industrialized nations started looking at different families of hard magnetic alloys, in quest of inventing, a system or systems of alloys that were not at the mercy of sources of supply raw materials, some of which were in politically and economically unstable regions of the world.

This was the genesis of Neodymium Iron Boron (NdFeB) magnets. In 1983, John Croat of GM and Sagawa of Sumitomo Specialty Metals Corporation invented the so- called MQ ( Magnequench) and sintered NdFeB permanent magnets, almost concurrently. In Fig(1), Yukata Matsuura of Neomax depicts the increasing trend in the energy product of NdFeB alloys.

Figure 1. Transition of world record energy product

The evolution of the NdFeB seemed to have a few more complications than that of its predecessors SmCo5 and Sm2Co17 systems of alloys. The lower Curie Temperature (around 315 degree centigrade), the magnet being prone to corrosion, coupled with lower thermal stability, were some of the unique undesirable characteristics, that for better or for worse separated this alloy from the Sm-Co families of permanent magnets.

The material scientists responsible for the invention of Nd based rare earth transition metal alloys did what any typical inventor does. They based their technology of the manufacturing of the new system of alloys, on an existing process that had proven effective and had been around for years. In this case, most of the manufacturing events were primarily based on the technology of powder metal process used for making Sm-Co.

Unfortunately, there were some vast differences between the two alloys. In the early days of Nd magnets it was not uncommon to prepare an alloy with a composition slightly richer in Nd as it was done with the SmCo alloys. None the less, an excess amount of Nd increased the level of Nd – rich phase in the grain boundary, which in turn made the magnet more prone to corrosion.

The second challenge for the manufacturer and for the end user was the fact that the magnet exhibited a much lower Curie temperature leading to higher reversible and irreversible temperature coefficient of induction and coercive forces. The end user did not have the luxury of taking the magnet to a high temperature and yet expect the device to perform as though the magnets were Sm based. So effectively we had a new family of permanent magnets that had room temperature characteristics of SmCo and yet the Curie temperature was even lower than that exhibited by hard ferrites.

II. ENHANCEMENT OF THE KEY WORKING PARAMETERS

The industry launched a systematic study to improve the unit magnetic properties of the Nd based magnets, thru the implementation of a host of process changes, and changes in the microstructure of the alloy. The lower Curie Temperature of NdFeB magnets is responsible for its higher reversible coefficient. Cobalt was added to increase the Curie temperature. But Cobalt does tend to reduce the anisotropy therefore the intrinsic coercive force, if the level of Cobalt exceeds a certain level. The latter limit is indicated to be around 10%. The coercivity of NdFeB magnets in practice amounts to no more than 20 to 40% of the theoretical limits. Sagawa and coworkers discovered that replacement of a portion of Nd by Dysprosium would enhance the anisotropy of Nd based alloy and thus increase the intrinsic coercive force. Immediately following Sagawa, Ghandahari and Fidler discovered that using Dy2O3 as a sintering additive also had a similar result. The latter was a low cost approach to the enhancement of the Nd based alloy. The addition of DY2O3, however, did introduce a much higher content of oxygen into the alloy (oxide causes decrease in the remanence and possibly provides easy nucleation sites for nucleation of domain walls) exhibited less homogeneous distribution of Dy into 2-14-1 grains. The practice of adding Dy became a more bona fide method for increasing the anisotropy of the alloy. Fig (2) shows the effect of Dysprosium on Br and Hci. Fig (3) is trend curve for the enhancement of Hci between 1980 and 2005.

Figure 2. The effect of Dysprosium on Br and Hci

Figure 3. Improvement of Nd-Fe-B sintered magnet coercive force

Thereafter, Dysprosium and Terbium (Dy and Tb) were added to increase the intrinsic coercive force. The latter did result in higher cost for the alloys and a partial loss of induction, as the heavy rare earths couple ferri- magnetically with transition metal and thus reduce the saturation magnetization. The accepted, typical rule was that for adding one percent of heavy rare earth, the intrinsic coercive force of the alloy will enhance by better than 1.5 Kilo Oersted. The important finding of use of Dy was the fact that up to 10% replacement of total rare earth, by Dy did result in increase in the intrinsic coercive force, beyond which there is a strong deviation from linearity. The doping of non- rare earth metals did show some promise of increasing the intrinsic coercive force. Use of metals such as Aluminum and Niobium may enhance the intrinsic coercive force to some extent as well. J.K.Chen and G.Thomas made two alloys where in one a portion of Iron was replaced by Aluminum while in the second alloy a percentage of Boron was replaced by Aluminum. Both showed a marked increase in the intrinsic coercive force with unfortunately higher than 4% decrease in the value of remanence.

The advent of “strip cast” process versus the “ingot cast” (cupcake or book mold type casting), allowed to make alloys with higher homogeneity and far better microstructure – another reason for greater improvement in the unit magnetic properties.

The above improvement made possible, the use of NdFeB in many new devices specially those that required exposure to higher temperatures and higher demagnetizing forces. The NdFeB magnet users and manufacturers therefore fell heavily for magnets using progressively more and more heavy rare elements, as the end users designed their magnetic circuits, conservatively, around alloys which may had much higher coercive force than they really required. The cost of the heavy additive was reasonable enough to justify such change.

III. PSEUDO STANDARDIZATION OF ALLOYS

The manufacturers decided to adopt a series of grade designations, where the last two letters of the alloy effectively indicated the nominal content of Nd, Dy and Tb. These were designated for example as N35, N38H, N38SH and N38UH, N35EH and etc. So a N38H alloy had a nominal Br of o 12.4 KGauss, and nominal Hci of 17 K Oersted, and supplied by most of the world class suppliers with essentially the same nominal unit magnetic properties. The content of the heavy rare earths typically varied from manufacture to manufacture by 0.5% or thereabouts.

While magnets of the same grade designation may be manufactured by different manufacturers, exhibiting essentially equivalent room temperature properties, the high temperature performance may vary from manufacture to manufacture as the technology of processing may not be of the same level of sophistication. Less technology savvy manufacturers of NdFeB magnets may have used a higher level of HREs in their alloy in an attempt to level the playing field of the magnetic performance, at higher temperatures.

This move, while may have been a good remedy, did seed some problems, both for the magnet suppliers as well as for the magnet users.

IV. HOW THE USE OF HRES AFFECTED THE DESIGNER’S OUTLOOK

Since the premium for the use of HREs was very small, the conservative designer may have used alloys with much higher intrinsic coercive force than he actually needed. In some cases the designer specified the knee of the magnet (at higher temperatures) clear in the third quarter of the magnetization curve. In other words some designer pushed the use of HREs to levels that ultimately became very expensive if not down right impossible. Some designers decided to go away from free Dy alloy to one with some Dy by content, by redesigning the magnetic circuit with thinner magnet, which allowed him (or her) the use of larger air-gap and less problems associated with mechanical dimensioning.

V. THE CHINESE GOVERNMENT IMPOSES NEW RULES ON MINING OF RARE EARTHS

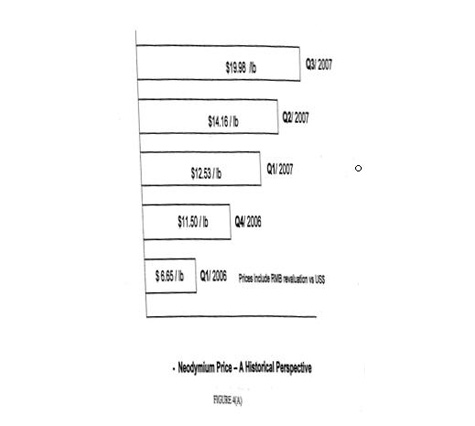

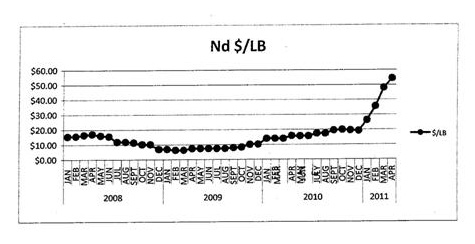

To usher in a semblance of order in the mining, usage and export of rare earths, the Chinese government changes the rules. The changes had a gradually increasing effect on the prices of rare earths across the board, while the HREs felt the effect more intensely as the fear of “balance” took a new dimension.In a nut shell, in the following five and one half years, the price of Nd metal went to higher than 700,000 RMB/ton, from a low of 45,000 RMB/ton, while Dy increased from 500 RMB/Kg ( or thereabouts) to 4,000 RMB/Kg – at the end of the first quarter of 2011.

Fig (4 a) and Fig (4b) shows the change in the price of Nd during the last decade.

Figure 4. The change in the price of Nd during the last decade

VI. THE END USERS DILEMMA

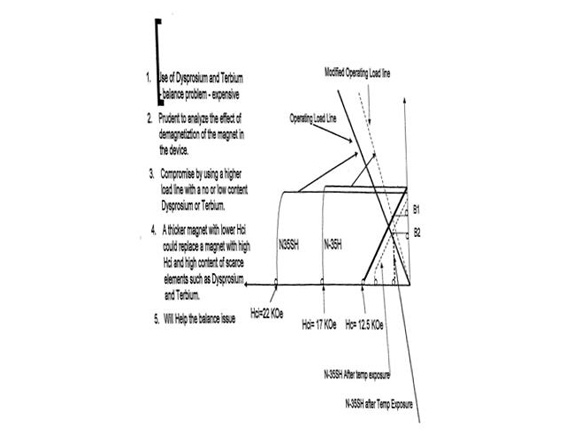

The designer was presented with three choices that could potentially solve his problem of not to cope with the thermal problems in his design.

(1) Use a thicker magnet – no expensive heavy rare earths.

(2) Design the system with much smaller air gap and move the operating point to much higher load line.

(3) Use a magnet replacing part of Nd with Dy or Tb at the expense of some sacrifice in the value of air gap flux or air gap flux density and risk the probability of not being able to buy heavy rare earths at all at some point in the future.

Fig (5) is Modified Operation load line and change of alloy.

Figure 5. Modified operation load line and change of alloy

Choice No.1 would mean use of larger device and larger foot print, Choice No.2 would make the cost of non- magnet portion of the circuit more expensive. Therefore choice no.3 was the most logical one to him. Un be-known to him and the magnet supplier the prices of Nd, and Dy would escalate from a low of 45,000 RMB /ton to high of better than 650,000 RMB /ton between year 2004 to 2011, with Dysprosium going thru the same multiple of price increases in China.

VII. INCENTIVE TO ELIMINATE OR REDUCE THE USE OF HRES

The word “balance” was used to point out the lop-sided ratio of light rare earths to heavy rare earths. This was an area of concern as for every 1700 pounds of Nd Oxide, they could produce only one pound of Dysprosium Oxide, in a typical Chinese Bastnasite deposit, while this ratio was around 25 times in the Chinese ionic ore. The ratio of Terbium Oxide to that of Nd oxide was even less favorable. Fig ( 6A ).

Figure 6A. The ratio of Terbium Oxide to Nd Oxide

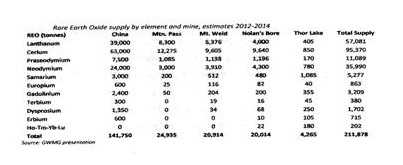

Chinese rare deposits happen to have a healthy of dose of HREs. The next known largest rare earth deposit in Mountain Pass California, now owned by Moly Corp has virtually no HREs, while there is no public report about the content of HREs the central Asian rare earth deposits.

So there could be better incentive than very higher prices generally for rare earth metals, compounded by limited availability of HREs. We see a concerted effort among the US end users to reduce the use HREs to an absolute minimum or purge such usage all together if possible.

Fig.(6B) shows the estimated supply of rare earth elements from known sources as of March 2010.

Figure 6B. The estimated supply of rare-earth elements from known sources as of March 2010

VIII. WHAT DO THE US MAGNET USERS DO

- They are designing new devices around Dy or Tb free alloys.

- The have grandfathered some of the old designs around alloys with HREs as changing those will be a virtual impossibility.

- They are looking at a completely different paradigm of design in that they spend a bit more money on the components (tighter tolerance, higher quality return structure) and use less rare earth of less heavy rare earths.

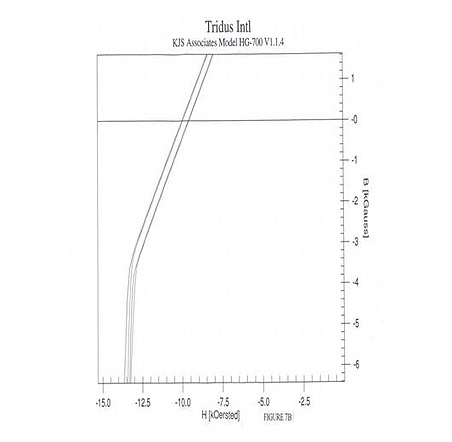

For example, in some motor applications for instance, the use of NdFeB magnets in hybrid cars, some manufacturers use higher heavy rare content alloy and avoid use of cooling system. In light of the scarcity of heavy rare earths, it may be more logical to incorporate cooling system and avoid use of heavy rare earths. - They specify their operating load line and the operating point of the magnet in the second quadrant curve and let the manufacturer decide what alloy they should use. Generally the designer uses a more conservative view in terms of unit properties, specifying more than required content of HREs. The designer specifies the coordinate fail safe coordinate of the magnet in the third quadrant. The manufacturer may be more prudent and cost conscious suggesting alloys that will meet the designers’ requirement, and not break the bank. See Fig (7) and Fig (7B).

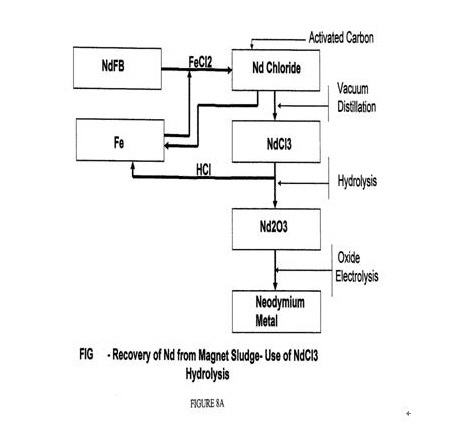

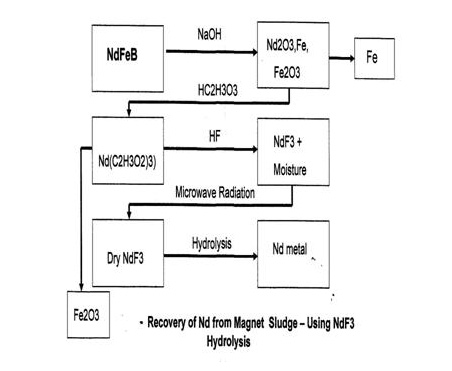

- The user may expect more transparency from the manufacturer. They put subtle or not so subtle pressure on the supplier to increase the yield and use more efficient technology to produce higher yield parts. When the cost of raw material quintuples, the user pays a lot more for the inefficiency of the supplier if the supplier is not able to recycle. Fig (8A) and Fig (8B) show the methods suggested, recycling Nd, some seven years ago. Recycling or reclamation is a de-facto method of increasing the yield today. This has become possible in light of the fact that the price of Nd and Dy has increased at least eight folds since 2004.

- Recycling becomes the mantra of the end user. They persuade the supplier to do the latter and share the return.

- Use of Dysprosium Grain Boundary Diffusion (GBD) is a technology that is somewhat promising. Nevertheless the cost of added process to accomplish the latter still needs to come down to make the process economically feasible. This process does use much lower content of Dy and the magnet can undergo the diffusion process selectively. For example a motor magnet can be diffused only in the area of the arc where it is more prone to the armature reaction.

- The effect of (GBD) has much lower effect on reducing the remanence of the magnet. GBD requires a much lower content of heavy rate earth to achieve the same level of coercivity as achieved with Dysprosium used in the melt process. Anecdotally this could be half or less than half of Dysprosium used in conventional cast.

Figure 7. Tridus International KJS associations Model HG-700 V1.1.4

Figure 8. Recovery of Nd from magnet sludge – using Nd3 hydrolysis

If the purpose of GBD is to reduce the usage of Dysprosium, this process is a bona-fide process. If the goal is to reduce the overall cost of manufacturing, there is some cloud over this issue at this point in time.

REFERENCES

- Yukata Matsuura: Current Status of NdFeB Magnets in Japan-China Magneitcs Shanghai, September 2006. China Magnetics , September 19-21, 2006 – Sofitel Hyland Hotel – Shanghai, China

- Y. Matsuura, S. Hirosawa, H. Yamamoto, S. Fujimura and M. Sagawa, “Magnetic Properties of the Nd sub 2 (Fe sub 1–x Co sub x ) sub 14 B System,” Appl.Phys, Vol. 46, no. 3, pp. 308-310, February. 1985

- M. Tokunaga, M. Tobise, N. Meguro, and H. Harada, “Microstructure of R-Fe-B sintered magnet,” IEEE Transactions on Magnetics, vol. 22, no. 5, pp. 904-909, September 1986

- S. F .Cheng, V. K. Shina, Y. Xu, J. M. Elbicki, E. B. Boltich, W. F. Wallace, S. G. Sankar, and D. E. Laughlin, “Magnetic and structural properties of SmTiFe11-xCox alloys,” Journal of Magnetism and Magnetic Materials, vol. 75, no. 3, pp. 330-338, December, 1988.

- J. K. Chen, G. Thomas- Al Substitution in NdFeB Magnets- High Performance Permanent Mag, Mater. Res. Soc. Symp. Proc., vol. 96, 1987.

- M. H. Ghandahari, J. Fidler, “Microstructural evidence for the magnetic surface hardening of Dy2O3-doped Nd15Fe77B8 magnets,” Material Letters, vol. 5, no. 7-8, pp. 285-288, July, 1987.

- Karl J. Strnat, H. Mildrum, T. K. Tran, “Sintered Nd FeB Magnets Modified with Holium and Cobalt,” The 10th International Workshop pm RE Magnets, vol. 1, pp.523, May 1989.

- J.Fedler and K.G.Knoch – The Influence of Dopants on Microstructure and Coercivity of NdFeB Magnets, The Proceedings of the Tenth International Conference on Rare Earth Magnets, 16-19 May 1989.

- Private dialogs with Y.Matsurra – in several conferences re Dysprosium Grain Boundary Diffusion- including during Magnetics 2011, February 28- March 2, 2011, San Antionio Texas , USA

- Naoko Oono, Massato Sagawa, R.Kasada, H.Matsui , “Production of High Performance Sintered NdFeB magnets by Grain Boundary Diffusion Treatment With Dysprosium–Nickel–Aluminum Alloy”,Journal of Magnetics and Magnetism ,Vol.323, no.3-4, pp.297-300, February 2011.

- Shinetsu Rare Earth Magnets – A Commercial Narrative on Grain Boundary Diffusion of Dysprosium – Shinetsu Rare Magnets- A Commercial Data Sheet – printed June 10, 2009.

- Lanthanide Resources and Alternatives- Oakdene Hollins Research & Consulting- A Report for Dept. for Transport and Dept. for Business, Innovation and Skills- March 2010 – UK

Tuesday, July 05, 2011

A Warning on Rare Earth Element

From WSJ.COM By DAVID FICKLING

SYDNEY—Demand for rare earth elements that has driven up prices more than tenfold since 2009 is likely to be met by a surplus of supply by 2013, as Western companies start up new mines to compete with the Chinese firms that now dominate the market, Goldman Sachs analysts predicted Thursday.

The forecast calls into question the sustainability of the current boom in rare earths, a suite of 17 elements used in products from high-powered magnets, and fuel refining to energy-efficient light bulbs and mobile phone screens, as well as the shares of companies seeking to produce them.

Prices of rare earths hovered between $5 a kilogram and $20 a kilo from the early 1990s until 2010. But a 40% cut in export quotas by China, which accounts for 90% of global rare earth production, sent prices soaring. The basket price of rare earths held in Lynas Corp. Ltd.’s Mount Weld deposit in western Australia—the largest non-Chinese mine, due to come to production in the next few years—has jumped to an average of $162.66 kilos from just $10.32 kilos in 2009.

Goldman’s view differs from that of miners. In a presentation last month, Lynas forecast that global demand for rare earths, which include neodymium, cerium and lanthanum, will outstrip supply this year by 35,000 tons this year and in 2012. Annual supply shortfalls of around 20,000 tons are expected in 2013 and 2014, it added. It predicted long-term prices in the $120/kg-to-$180/kg range.

Lynas Chief Executive Nicholas Curtis says China is on the verge of becoming a net importer of the elements, a transformation that would be similar to those that drove major shifts in global markets for coal in 2009 and oil in the mid-1990s, and could accentuate the current price spike.

“China will become a net importer because its consumption for its own domestic value-added industry is going to drive very high [demand] growth for these resources. They’ve explored every inch of China for what’s available and if they had more rare earths deposits of any size, it would be being developed now,” he said in a recent interview.

Lynas shares have risen fourfold since China announced the quota cuts in July 2010.

Goldman Sachs analyst Malcolm Southwood, however, said the price boom is nearing its peak. The supply deficit will peak at 18,734 tons this year, equivalent to 13.2% of a forecast 141,524 tons of demand, before the market slips into a slight surplus in 2013, he said in the report published Thursday. The surplus will rise to 5,860 tons or 3.2% of projected demand in the following year, the report said.

Initially, at least, prices will likely continue to rise, he said. The basket price for the Mount Weld rare earths should climb to $227 a kilogram next year, a gain of about 40%. Prices may eventually moderate to an average of $82 a kilogram, but that will happen only in 2015, the third consecutive year of a global surplus, the report said.

“We envisage a closely balanced market in 2013, and modest surpluses thereafter—at least, for some of the more abundant light rare earths—with some price softening in the 2013-2015 period,” according to the report.

Goldman’s view matches the outlook of many other market participants who believe the current boom is overdone. “For [the rare earths such as] cerium and lanthanum, there will certainly be some surplus,” said a major European rare earths trader, who didn’t want to be named because of the sensitivity of trading relationships.

“When you have these high prices, people immediately start to look for substitutes, and it takes one to two years, but people can switch out of rare earths.”

He cited the glass industry, which has replaced its consumption of cerium with selenium over the past year as prices of the rare earth rose to $135 per kilo currently from just $3.88 per kilo in 2009.

Other analysts see prices falling much closer to historic averages as new projects come onstream, particularly if continued high prices encourage the development of major deposits such as Greenland Minerals & Energy Ltd.’s Kvanefjeld site, which is more than twice the size of Mountain Pass and Mount Weld combined, but located on an isolated mountainside just south of the Arctic circle.

“Lynas has said their production costs are $10 per kilogram. If they think they can sell their material at $150 a kilogram, a markup of 15 times, I don’t know customers are going to be prepared to pay for it,” said Dudley Kingsnorth, executive director of Industrial Minerals Company of Australia, a rare earths analysis house.

“Once these new mines come onstream, there will be a fall in price, and if miners insist on multiples of 15-20, they’re going to face more competitors. They’re going to have to face a little bit of reality.”

Read more: http://online.wsj.com/article/SB10001424052748703992704576304712512256774.html#ixzz1LVnCmd9a

End of cheap rare earth?

BEIJING / news.xinhuanet.com (Xinhua) / April 5, 2011 – As China, the world’s largest producer of rare earths, tackles concerns about an over-expansion of rare earth mining and its environmental damage, analysts say that this might signal an end to cheap rare earth supplies from China.

Rare earths, a collection of 17 elements in the periodic table, are among the most sought-after materials for modern manufacturing. In tiny amounts, their unique magnetic and phosphorescent properties make them vital ingredients for producing sophisticated products like flat-screen monitors, electric car batteries, wind turbines, missiles and aerospace alloys.

However, mining the elements is difficult, costly and polluting.

China now supplies more than 90 percent of the world’s rare earth demand, even though its reserves only account for about one-third of the world’s total.

Over the past decades, the export prices for China’s rare earths were comparatively low due to a lack of environmental protection costs.

In the late 1990s, as Chinese mines started to compete in the market, prices fell and most producers outside China closed. However, supplying most of the world’s demand has left China with many problems, including serious environmental pollution and sharply reduced reserves after decades of exploration.

To protect the non-renewable resources and control environmental damage, the Chinese government announced a series of measures that include cuts in export quotas, crackdowns on illegal mining and mineral smuggling, a halt to new mining licenses and the introduction of production caps.

Since the beginning of this year, the average price of the 17 rare earth elements have doubled in China from the end of 2010. Analysts have accused speculators of targeting rare earth for huge returns and pushing prices beyond the supply and demand fundamentals of the market.

However, Xing Bin, the executive deputy general manager and chief financial officer of the Inner Mongolia Baotou Steel Rare Earth (Group) Hi-Tech Co., considers the current price increase as a revaluation process that would bring the price back to a reasonable level.

“The price increase will not endure and the prices will stabilize again when it strikes a balance between the demands of suppliers and consumers,” Xing said.

China’s latest move, a new resource tax on rare earths beginning in April, would further fuel the price rises, analysts said.

The tax rate was set at 60 yuan (about 9.15 U.S. dollars) per tonne of mined light rare earths, while the rate for medium and heavy rare earths was set at 30 yuan per tonne. Rare earths were previously taxed under the category of ordinary non-ferrous metals, with tax rates between 0.5 and 3 yuan per tonne.

Yang Wanxi, the director of a rare earth expert panel under the Baotou Municipal Committee of Sciences, said that rare earth prices have shot up exponentially in recent months because of many reasons, adding that China’s new resource tax would add fuel to the price rises.

“In a word, the era of cheap rare earth supplies might have come to an end,” Yang said.

He suggested that the revenue from the new levy should be used to fund research and development on rare earth processing and application technologies, set up environmental compensation funds and build rare earth reserves.

Xing said that the tax would increase the cost for rare earth firms and lead to higher prices when the costs are passed to consumers.

Zhang Zhong, the general manager of the Inner Mongolia Baotou Steel Rare Earth (Group) Hi-Tech Co., told Xinhua that the tax would increase the company’s production costs by about 720 million yuan this year.

The resource tax came after the announcement in January of tougher emission limits for rare earth mining and smelting. The emission caps on about 15 pollutants, announced by the Ministry of Environmental Protection, will take effect on October 1 this year.

In addition to the new tax, the emission caps would also add companies’ operation costs. Further, it is widely expected that the national reserve policy would come out soon and would push up rare earth prices, said Yang Baofeng, an analyst with the Shanghai-based Orient Securities.

Inner Mongolia will accelerate the construction of a rare earth strategic reserve base and will establish a national rare earth reserve to pave the way for a potential rare earth trading platform, Hu’ercha, the deputy director of the Standing Committee of the People’s Congress of Inner Mongolia Autonomous Region, said early last month.

The Ministry of Land and Resources (MLR) announced in January the establishment of eleven state-managed rare earth mining zones in Ganzhou in east China’s Jiangxi Province. The sites are rich in ion-absorbed-type rare earths.

The MLR also said that the country would cap this year’ s rare earth output at 93,800 tonnes from 89,200 tonnes last year and would not grant new licenses for rare earths prospecting and mining before June 30, 2012.